#Business Analogy 037 - Matthew Effect - Reinforcing Feedback Loops - Parable of Minas & Talents - Hares & Foxes - Lucas Paradox & Brain Drain - Click Farms - Venture Capital Investing

Rich gets richer and poor gets poorer. Content with more clicks gets shared with more people the algo promotes it naturally

Luck begets luck

Fame begets fame

Investment begets investment

Riches beget riches

Power begets power

Skill begets skill

Reputation begets reputation

This is the effect of accumulation and compounding; this is also the effect of deaccumulation and de-compounding. It works both ways, not just positive but also negative.

Let’s try to understand this effect with a thought experiment

THOUGHT EXPERIMENT

THE FAMOUS WRITER

You have sold over 400 million copies of your books worldwide over the last 10 years, and you are ecstatic. Your latest book created records for the most copies sold in the first 24 hours.

You threw a great party, and you invited your best friend to toast you on this occasion.

Your friend threw a boomerang at you, and instead of praising your accomplishments, announced this into the microphone, “You are only able to sell the books, not because you are a great writer, that ship sailed a long time ago. You are only able to sell the books because you are now famous. And because you are a famous writer, everyone knows about your books, and so they sell. But I bet after the first week or so, your books won’t sell anymore. They don’t remain in the best seller charts after the first week or two”.

The entire party fell silent, and you were stumped and embarrassed. You wanted to save your face, so you instructed your friends to grab the loudmouth away from the stage.

Your cotire around you tried to justify the action, “He is just jealous of your success,” said one. Another one in the entourage whispered, “He had one too many drinks this evening.” But the words stuck in your brain, you can’t get them out. The next day, your thoughts were reeling.

“Am I still the writer I was?” you thought, “or did I lose my charm?”

You wanted to put this to the test.

So you approach your publisher, for the last 10 years, and request him to do you a favour, “I want to check if people would buy my work if I don’t have my name on the book”. For some strange reason, your publisher agreed.

In April 2013, Little Brown published your book, The Cuckoo’s Calling, under the assumed author name, Robert Galbraith, an ex Royal Military Police Investigator, retired in 2003, to work in the private security industry.

It is a crime detective novel and has only sold 1500 copies. In fact, 1500 copies were printed for the first test run, and a meagre 500 copies were sold.

More than 90% of the books from first-time writers never sell more than a few hundred copies. This is a fact, but it came as a surprise because you are not a first-time writer; you have been writing for the past decade and have sold hundreds of millions of copies.

But the reality is disturbing. Why did nobody read your book? Is your friend right all along? Was he vindicated? Were you just selling your books based on the fame you have accumulated over the past 10 years?

You wanted to put that to the test, too!

So you did something remarkable in a press release and announced that you are Galbraith.

Four months after Cuckoo’s Calling was first published, the sales skyrocketed by 4000 per cent. This happened when it was revealed that Robert Galbraith was a pseudonym used by J.K. Rowling, author of the Harry Potter series and the United Kingdom’s best-selling living author.

J. K. Rowling isn’t the only one who has experimented with pseudonyms. Another famous novelist, Stephen King, published a handful of short novels under the pseudonym Richard Bachman. He wanted to test whether he could replicate his success again. Unfortunately, the experiment confirmed his fears that his popularity wasn’t entirely a result of his talent.

Both Stephen King and J.K. Rowling had a rude awakening.

What this thought experiment reveals is that famous people attract more fame by virtue of fame. Fame is accumulated over the years, it is carefully cultivated, and the more famous you are, the more you become.

It is easier for the famous to acquire more fame; it is almost impossible for an obscure writer to become famous, even if they are quite talented.

The same is true for other domains as well. Riches, Skills, Education, networks, etc…

This is the Matthew Effect. We will explore the Matthew effect in detail in this article.

The rich will not always get richer, the famous will not always get more famous, but the game is rigged in their favour.

Let’s try to understand the Matthew Effect with another PARABLE from the BIBLE.

PARABLE

The Parable of Talents

Three servants were each given talents (unit of weight) of gold for safekeeping by their master according to their abilities. The first servant received five talents of gold, the second received two, and the third received only one. The first two servants invested their talents in gold and earned a return on their investment. The third servant buried his talent of gold to keep it safe and earned nothing.

The Parable of Talents can also be used to justify that hard work pays off, but the third servant couldn’t do much with one talent of gold, and as asked, he did keep the gold safe!

After a long absence, the master returned and asked for an account of the talents of gold entrusted to them. The master rewarded the first two servants and punished the third, taking away his talent and giving it to the first servant.

As Matthew 25:14-30 says,

“For unto every one that hath shall be given, and he shall have abundance: but from him that hath not shall be taken even that which he hath.”

This anecdote, known as the “Parable of the Talents” from the Gospel of Matthew, inspired Robert K. Merton to coin the term “Matthew Effect” in 1968. Matthew Effect is the tendency of individuals to accrue social or economic success in proportion to their initial level of popularity, friends, and wealth.

This phenomenon occurs due to societal structures and recognition systems that tend to favour those already in the limelight. As a result, those with initial advantages receive more opportunities, leading to a cycle of ever-increasing success, often regardless of their intrinsic aptitude.

CONCEPT

MATTHEW EFFECT

The Matthew Effect is essentially a feedback loop that is amplified repeatedly.

A RunAway Reinforcing Feedback loop, both negative and positive.

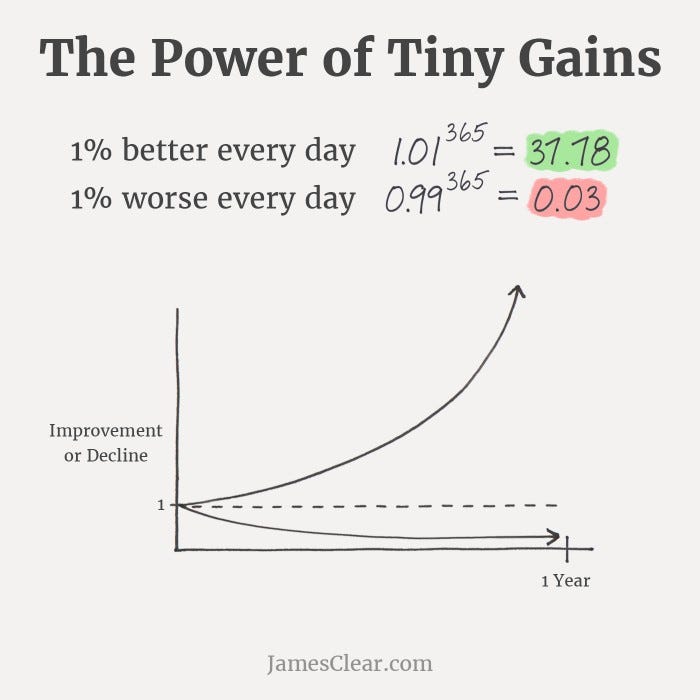

If there is one graph that can capture the Matthew effect, both positive and negative, it is this one that shows.

One percent Improvement Every Day - slow gains vs slow losses.

At the end of one year, the difference is 37.78/0.03 = 1260x times the original.

If this continues for 10 years, the difference will be

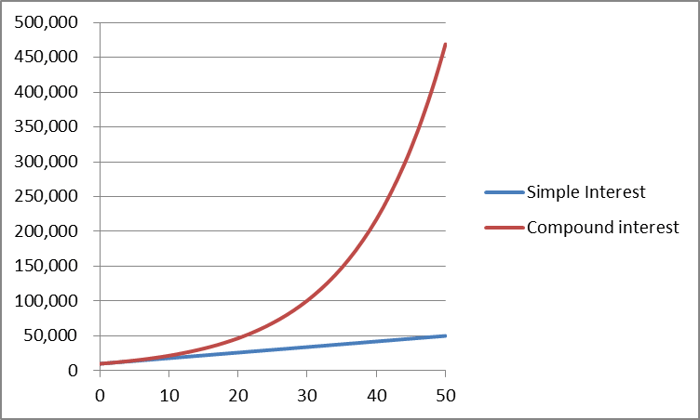

A Reinforcing feedback loop can be observed in finance through the concept of compound interest.

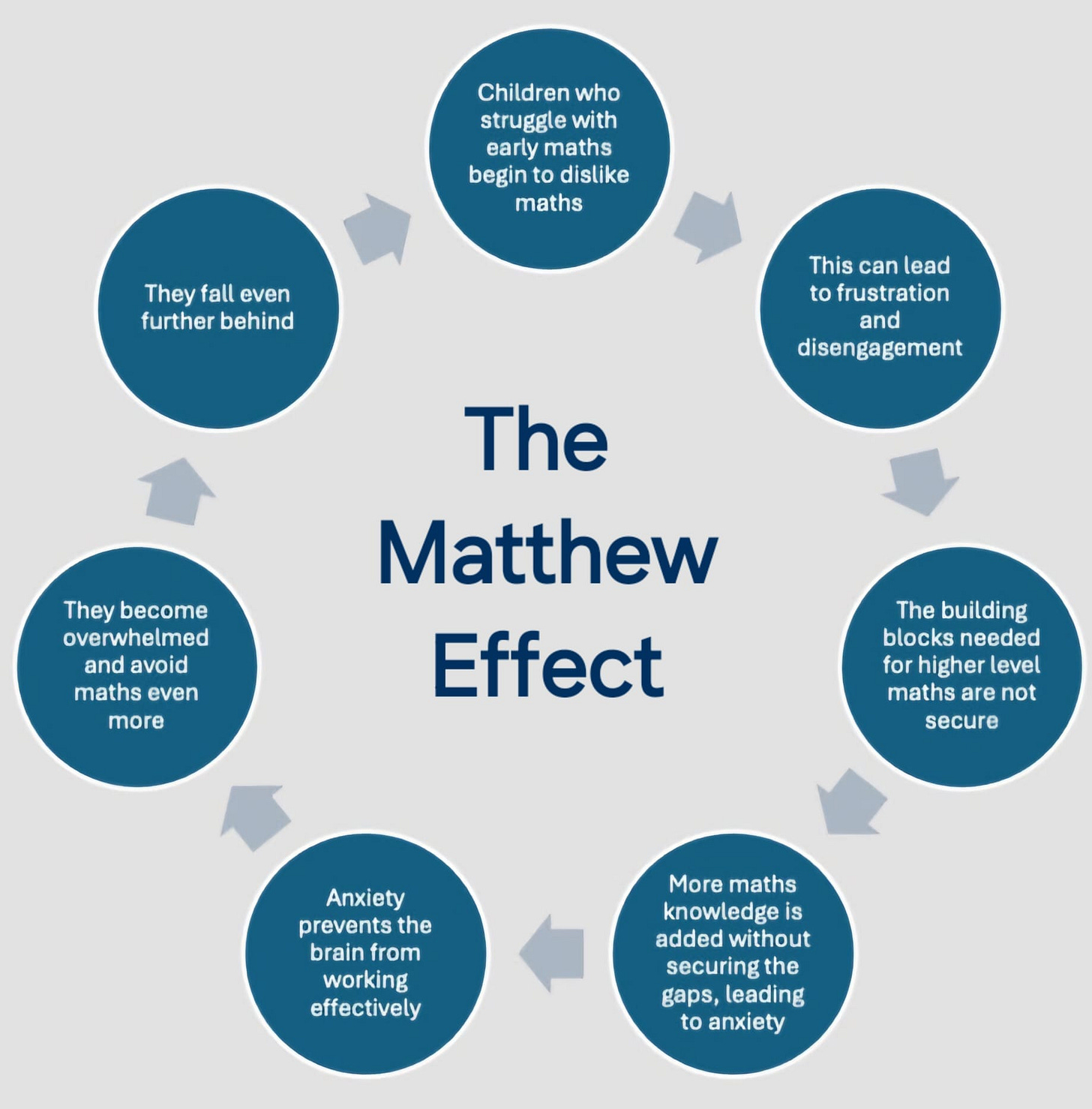

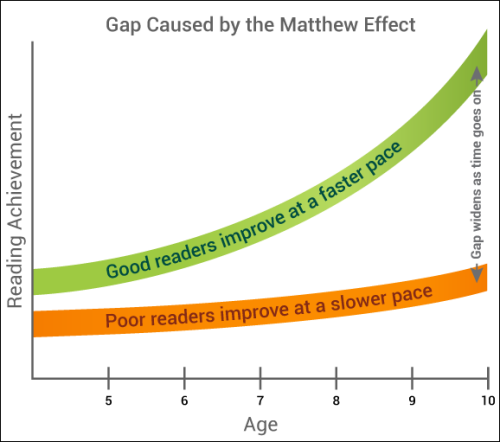

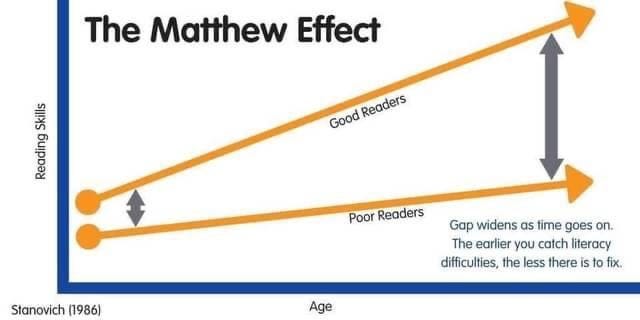

The Matthew Effect is observed in education, where individuals with advanced reading skills acquire the necessary vocabulary that enables them to read more effectively.

In careers, Initial professional success attracts more opportunities, leading to even greater success.

Think of two professionals starting out:

• One lands a role at a well known brand early on.

• Another, equally skilled or even more talented, starts with a lesser-known company.

Over time, the first person’s company logo on his/her resume keeps opening doors, boosting visibility, expanding networks, and creating more opportunitie,s while the second has to fight much harder for the same ground.

Early breaks matter because recognition and success often attract even more recognition and success.

In all these graphs, the initial conditions are shown to be similar, i.e., both lines start from the same point. However, in real life, nobody begins from the same starting line in a race.

For some, life offers significant advantages by birth, geography, or circumstance, but for others, it presents substantial disadvantages.

For instance, students who can usually afford an Ivy League education (elite research universities) come from clearly wealthy families, as the annual tuition fee is around 55,000 Dollars (yes!). Based on their education, they then develop better skills and connections through their schooling, family ties, and ever-present acquaintances. The rich get richer! Consequently, they are more likely to gain more than their counterparts who belong to a lower socioeconomic status. The poor get poorer.

Some start with a surplus, while others start their life in debt.

The short story below illustrates how the Matthew Effect operates in the context of power/war/networking.

AESOP FABLE

The Hares and the Foxes

The hares were at war with an eagle, and they asked the foxes to be their allies.

The foxes said in reply,

‘We would agree to be your allies, if we didn’t know what sort of creatures you are and who you are fighting against!’

This fable warns that people who attack someone more powerful than they are often find themselves without allies.

The strong, by their strength, get natural allies. The weak find themselves without any friends.

Power begets power. Weakness begets weakness.

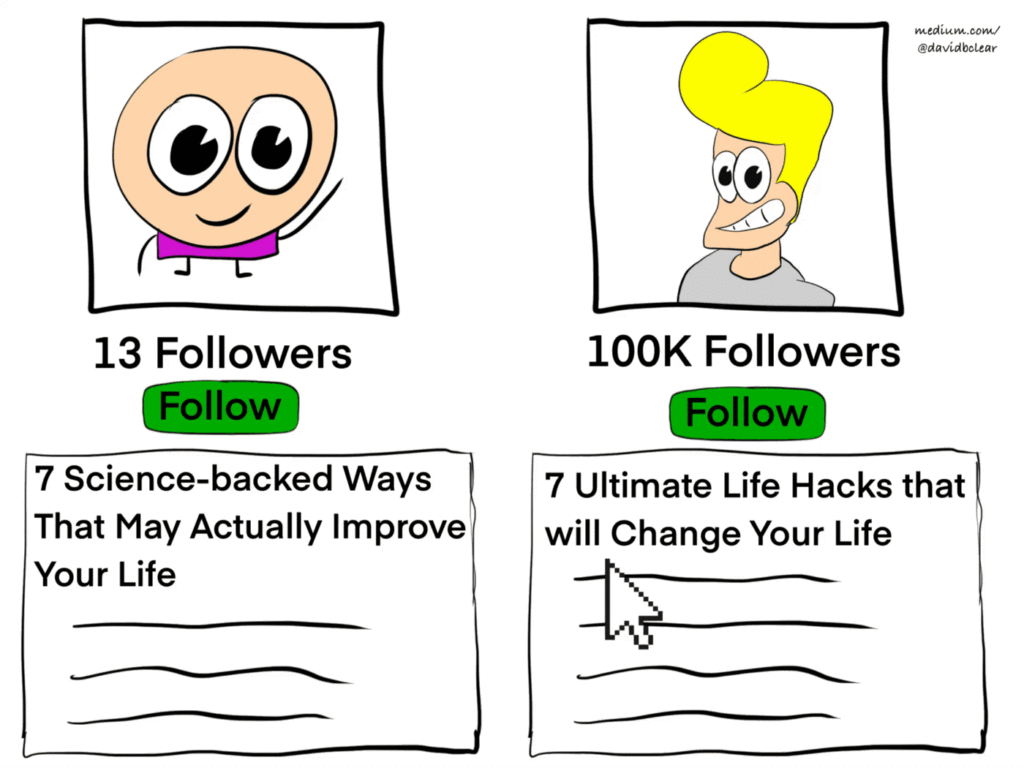

Let’s look at a real-life application of Matthew Effect in Social Media. Where Likes get more likes, views get more views, and shares get more shares.

It is not easy to break out of the Matthew Effect; for some, it is almost impossible. Here is a funny short story. It is not easy to buy reputation or acquire status without first having some status to begin with.

SHORT STORY

GRADUAL RISE TO FAME

Nasrudin had been travelling through Central Asia for some time and had learned a universal fact that linked all the countries in the region.

It was that there was nothing quite so important as having a reputation.

No reputation, and you were likely to be trodden underfoot.

So, before approaching the village of Ivanovka, he gathered together a group of boys and offered them a handful of coins in return for publicizing him there.

“Go to Ivanovka and tell everyone you meet that the world-famous explorer, Nasrudin, is about to arrive. Do you understand?”

Nodding, the boys took the coins and set off across the fields to the next village.

That evening, they returned.

“You did do as I asked?”

The boys said that they had.

“And were people astonished, delighted, and amazed?” the wise fool asked urgently.

“No, no one was impressed,” said the oldest boy.

“Some jobs have to be done by a professional!” Nasrudin exclaimed.

The next morning, as the dawn broke over Azerbaijan, he dressed in his finest clothing, festooned his donkey in a strand of scarlet silk, and set off over the fields.

Riding tall, he rode into Ivanovka, his chest pushed out like a warrior returning from battle.

No one showed the least bit of interest.

“Here I am!” the wise fool yelled at the top of his lungs.

Still no interest.

“Here I am! Yes, it’s me! It’s Nasrudin, the world-famous explorer!”

“If you’re so famous, why haven’t we heard of you?” a homeless man begging in the main square spat.

“Well, I paid those stupid boys from the other village to tell you about me yesterday!”

The beggar hissed rudely.

“If you were really famous, you wouldn’t need to pay children to do your publicity.”

“That may be true,” Nasrudin retorted angrily, “but I’m working my way up the celebrity ladder gradually. How d’you expect me to become really famous until I’ve been moderately famous first?”

This story illustrates that attaining celebrity status is not easy unless you are already a celebrity.

CASE STUDY

CLICK FARMS

The Matthew effect states that strong individuals become even stronger, while those who lack status become weaker. Matthew effect is present in all walks of life, but I have chosen to present one area where it is visible online.

In Social Media, you can see that the posts that have a significant number of likes get all the likes, the posts with more comments get even more comments, and the posts with a greater number of views get more views.

This is because the recommendation algorithms on all social media platforms are coded with the Matthew effect, i.e., the algorithms are trained to identify videos, posts, and images with a high number of likes, shares, and comments, and then suggest them to others and display them in the feeds of others. Thus, posts that receive likes tend to gain more likes, and videos with more views tend to gain more views, and so on, until infinity.

The image above illustrates how the video with more views, likes, and comments is detected by the algorithms and recommended to more people, which in turn increases its views, shares, and comments.

The Matthew effect is behind the virality of certain videos, while others remain dormant. All the while, many have understood that they need to hack the system, i.e., they must trick the system into recommending their content more.

Enter Click Farms.

What if we can get the first 5k - 10k likes, comments, and shares using fake accounts? and get the algorithm to recommend this content?

Well, this is precisely what the Chinese Click Farms solve.

You can watch the videos below to get a rough idea of what click farms are.

ANALOGY

RIGGED MONOPOLY GAMES

To understand the Matthew Effect better, we need to grasp that minor initial differences can become exponentially significant over time.

These dynamics can be best understood with a skewed Monopoly Analogy.

In the board game Monopoly, every player begins with the same amount that the bank gives them. But in real life, a different version of Monopoly is played. Some of them get millions, while others start with debt. These initial differences compound over the lifetime. While the rich make compound interest, the poor, on the other hand, accumulate compound debt until the end of their lives.

A rigged monopoly experiment triggers a far more vicious Matthew effect.

CONCEPT

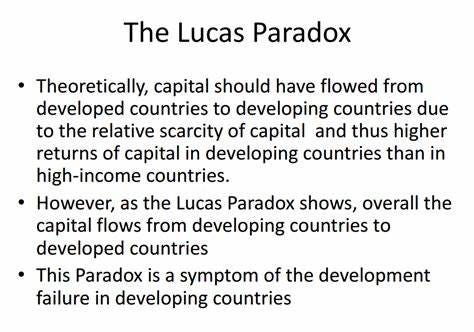

LUCAS PARADOX & BRAIN DRAIN

Why does all the capital flow from the developing nations to the developed nations?

Why does all the brain power drain from the developing nations to the developed nations? Should it not be the reverse?

Those who need it desperately do not get it, but those who don’t need it have an abundance of it, and more keeps flowing towards them. Why?

Those who need credit desperately will have to pay a heavy premium to get it, the poor people. The people who don’t actually need it, i.e., the Rich, get the loan for free, no interest.

This is the LUCAS PARADOX, and of course, the reason is THE MATTHEW EFFECT.

Closely related to this phenomenon is brain drain, or the recruitment and development of scientific and other educated talent, usually though not always from less- to more-developed countries. This tends to benefit the latter at the expense of the former. Brain drain has been described as a kind of human capital flight: Like the flight of financial capital from less to more advantaged countries, they drains much-needed resources from poorer nations and hinders their development. Brain drains thus tend to reinforce the power and privilege of nations at the center of the world system while stifling efforts among nations on the periphery to escape dependency.

CASE STUDY

MATTHEW EFFECT IN VENTURE CAPITAL & PRIVATE EQUITY

$5,000 turned into $25 million.

$220,000 became $1.1 billion.

That’s what some of Uber’s earliest investors made.

Back in 2010, Uber was trying to raise just $1.25 million.

Mark Cuban passed. Gary Vee said no twice.

But a handful of angels took the leap.

When Uber went public at an $80 billion valuation, those early checks became generational wealth.

This is what early-stage investing looks like:

▫️ 90% of startups don’t make it

▫️ One right bet can pay for all the others

Scroll through Uber’s original cap table below.

This is what real conviction looks like.

Thanks to Kevin Jurovich for sharing this one.

If you could take a quick look at the table, you can quickly realize that almost all the investors obtained their wealth from previous startups, either by taking exits or by building startups from scratch, except for one, Jason Port, who works with a Venture Capital Firm.

This is a Matthew Effect of Investments in Venture Capital.

The rich invest in startups; some of them yield exorbitant profits. These profits are reinvested in more startups, triggering a virtuous loop of investments. Startup founders become investors, eventually investing in many more startups. They use the expertise and experience they have gained running successful startups to identify such startups that can multiply wealth.

To understand the Matthew Effect and the underlying principles that drive the Matthew Effect, you can read the book with the same name or check out the appendix.

The Matthew Effect: How Advantage Begets Further Advantage

by Daniel Rigney Ph.D. (Author)

A Short story from the Middle East aptly captures these initial differences and their consequences in full light.

FOLKTALE

GOD's WAY OF DISTRIBUTION

One day, four boys approached Hodja and gave him a bagful of walnuts.

“Hodja, we can’t divide these walnuts among us evenly. So would you help us, please?”

Hodja asked, “Do you want God’s way of distribution or mortals’ way?”

“God’s way,” the children answered.

Hodja opened the bag and gave two handfuls of walnuts to one child, one handful to the other, only two walnuts to the third child, and none to the fourth.

“What kind of distribution is this?” the children asked, baffled.

“Well, this is God’s way,” he answered. “He gives some people a lot, some people a little, and nothing to others. If you had asked for mortal’s way, I would have given the same amount to everybody.”

JOKE

HOW TO GET RICH

A young man asked an old, rich man how he made his money. The old guy fingered his worsted wool vest and said, “Well, son, it was 1932. The depth of the Great Depression. I was down to my last nickel. I invested that nickel in an apple. I spent the entire day polishing the apple and, at the end of the day, I sold the apple for ten cents. The next morning, I invested those ten cents in two apples. I spent the entire day polishing them and sold them at 5 pm for 20 cents.

I continued this system for a month, by the end of which I’d accumulated a fortune of $1.37.

Then my wife’s father died and left us two million dollars.”

One of the core reasons behind the Matthew Effect is the Inherited Advantage.

INHERITED ADVANTAGE

Through the luck of the birth lottery, some are born into advantage, while others are born into disadvantage. Mark Twain’s ironic remark that he chose his parents wisely reminds us that we do not control the time, place, or social circumstances of our births. Some are born with relatively easy access to opportunity structures, others begin life with almost no access, and still others—most of us—fall between the extremes. But whether we are born rich, poor, or in between, we are all subject to the luck of the lottery, and the social locations of our births substantially influence our subsequent life chances.

MYTH

DEBUNKING THE SELF-MADE MILLIONAIRE MYTH

The self-help industry is rife with stories about the self-made billionaire troupe, often told and retold so many times that it has become trite.

The Self-Made Hero troupe.

Building himself up from his bootstraps, the billionaire, Playboy philanthropist, rock star celebrity born to poor immigrants under modest circumstances with grit, talent, fights, and wins battle after battle, and climbs his way to greatness and builds his empire. The self-help industry makes everyone drink this Kool-Aid.

The reality is that most of these entrepreneurs were born into riches and had initial advantages, also known as unfair advantages. Luck played a more significant role in runaway success stories than hard work. Initial advantages, no matter how slight, have the potential to distort outcomes significantly.

Gladwell writes –

It is those who are successful who are most likely to be given the kinds of special opportunities that lead to further success. It’s the rich who get the biggest tax breaks. It’s the best students who get the best teaching and most attention..Success is the result of what sociologists like to call “accumulated advantage.”

Nassim Taleb, in his book Black Swan, argues –

This theory can easily apply to companies, businessmen, actors, writers, and anyone else who benefits from past success. If you get published in The New Yorker because the color of your letterhead attracted the attention of the editor, who was daydreaming of daisies, the resultant reward can follow you for life. More significantly, it will follow others for life. Failure is also cumulative; losers are likely to also lose in the future, even if we don’t take into account the mechanism of demoralization that might exacerbate it and cause additional failure.

Again, every initial advantage doesn’t turn into a success story. But whenever you see a successful person, don’t ignore the possibility that an initial advantage got him or her into a series of events supported by a positive feedback loop, and over a period of time, the accumulated advantage resulted in the final outcome.

In an excellent book, Everything Is Obvious, the author, Duncan Watts, writes on the Matthew effect –

…when we try to explain why some individual is rich or successful common sense insists that the outcome arises from some intrinsic quality of the object or person in question. A best-selling book must be good some-how or else people wouldn’t have bought it. A wealthy man must be smart in some manner or else he wouldn’t be rich. But what the Halo Effect and the Matthew Effect should teach us is that these commonsense explanations are deeply misleading. It may be true that abjectly incompetent people rarely do well, or that amazingly talented individuals rarely end up as total failures, but few of us fall into those extremes. For most of us, the combination of randomness and cumulative advantage means that relatively ordinary individuals can do very well, or very poorly, or anywhere in between.

None of this is to say, of course, that people, products, ideas, and companies don’t have different qualities or abilities. Nor does it suggest that we should stop believing that quality should lead to success. What it does suggest, however, is that talent ought to be evaluated on its own terms.

The cynic’s question, if you’re so smart, why aren’t you rich? is misguided not only for the obvious reason that at least some smart people care about rewards other than material wealth, but also because talent is talent, and success is success, and the latter does not always reflect the former.

X-X-X-X-X-X END OF THE ARTICLE X-X-X-X-X

But you can keep learning more about the Matthew Effect from the Appendix below.

APPENDIX A

INVERSE MATTHEW EFFECT - PUNISHED FOR SUCCESS

Most people know the Matthew Effect—the law of accumulating returns:

“Those who have, more will be given.”

In essence, success tends to build on itself.

But in sales, there’s often an inverse Matthew Effect—where those who succeed the most are paradoxically penalized for their success.

Example: Sales Quotas

Imagine a sales team where:

One rep consistently achieves 200% of quota.

The rest average 80%.

When management hires a new salesperson and needs to divide territories, whose territory gets cut?

Usually, the top performers.

Why?

Because managers feel compelled to make things “fair” and to avoid appearing as though one rep is outperforming due to a “better territory.”

In trying to balance performance, they unintentionally punish excellence.

Contrast with Engineering

In engineering, the opposite dynamic occurs:

If one engineer produces exceptional, bug-free code and creates major value, they’re typically rewarded—given more freedom, equity, or flexibility—because their contribution is recognized as disproportionately valuable.

APPENDIX B

MATTHEW PRINCIPLE IN ECONOMICS

A Simple Economic Example: The Luck-Based Economy

Imagine an economy where everyone starts with $100 and bets half their money each round on a coin toss.

Winners double their bet.

Losers lose what they bet.

The total wealth in the system stays constant, but it becomes unevenly distributed over time.

After ten rounds:

The player who wins every time ends up with $5,766.

A player who’s 90% lucky (loses once) ends with $1,922.

A 50/50 player ends with just $23.73.

Even small differences in luck compound dramatically—illustrating how inequality naturally emerges, even in a fair game.

Extending the Model Beyond Luck

In real economies, outcomes aren’t based on luck alone but also on talent, hard work, timing, and access to opportunity.

Yet, the same pattern holds: those who start ahead accumulate more resources, stability, and options, while those behind face compounding disadvantages.

Over time, wealth and opportunity follow power-law distributions, where a small fraction of participants hold a disproportionate share.

Broader Manifestations

Attention Inequality:

Platforms like YouTube or Spotify favor content that’s already popular. Algorithms recommend what others have liked, causing attention to cluster around a few creators while others remain invisible.Academic Citations:

Frequently cited papers appear higher in search rankings (e.g., Google Scholar), attracting even more citations—a feedback loop of visibility.Network Effects (Metcalfe’s Law):

Larger networks grow exponentially more valuable. A platform with slightly more users can become vastly more dominant, concentrating influence and access.

Takeaway

The Matthew Principle reveals a universal pattern:

Advantage compounds. Disadvantage compounds.

Without counterbalancing mechanisms—such as redistribution, access to opportunities, or algorithmic fairness—systems naturally drift toward the concentration of wealth, power, and attention.

APPENDIX C

PARABLE OF MINAS

This Parable is similar to the Parable of the Talents.

A nobleman went into a far country to receive for himself a kingdom and then return. Calling ten of his servants, he gave them ten minas, and said to them, ‘Engage in business until I come.’ But his citizens hated him and sent a delegation after him, saying, ‘We do not want this man to reign over us.’ When he returned, having received the kingdom, he ordered these servants to whom he had given the money to be called to him, that he might know what they had gained by doing business. The first came before him, saying, ‘Lord, your mina has made ten minas more.’ And he said to him, ‘Well done, good servant! Because you have been faithful in a very little, you shall have authority over ten cities.’ And the second came, saying, ‘Lord, your mina has made five minas.’ And he said to him, ‘And you are to be over five cities.’ Then another came, saying, ‘Lord, here is your mina, which I kept laid away in a handkerchief; for I was afraid of you, because you are a severe man. You take what you did not deposit, and reap what you did not sow.’ He said to him, ‘I will condemn you with your own words, you wicked servant! You knew that I was a severe man, taking what I did not deposit and reaping what I did not sow? Why then did you not put my money in the bank, and at my coming I might have collected it with interest?’ And he said to those who stood by, ‘Take the mina from him, and give it to the one who has the ten minas.’ And they said to him, ‘Lord, he has ten minas!’ ‘I tell you that to everyone who has, more will be given, but from the one who has not, even what he has will be taken away. But as for these enemies of mine, who did not want me to reign over them, bring them here and slaughter them before me.’

APPENDIX D

MATTHEW EFFECT IN SCIENTIFIC PUBLISHING

In his initial work, Merton describes how, among other things, prominent scientists often receive more acclaim than unknown researchers, even if their work is of lesser quality.

Let’s say someone writes an academic paper quoting fifty people who have worked on the subject and provided background materials for his study; assume, for the sake of simplicity, that all fifty are of equal merit. Another researcher working on the exact same subject will randomly cite three of those fifty in his bibliography. Merton showed that many academics cite references without having read the original work; rather, they’ll read a paper and draw their own citations from among its sources. Thus, a third researcher, reading the second article, selects three of the previously referenced authors for their citations. These three authors will receive increasingly more attention as their names become more closely associated with the subject at hand. The difference between the winning three and the other members of the original cohort is mostly due to luck: they were initially chosen not for their greater skill, but simply because their names appeared in the prior bibliography favorably. Thanks to their reputations, these successful academics will continue writing papers, and their work will be easily accepted for publication. Academic success is partly (but significantly) a lottery. *

It is easy to test the effect of reputation. One way would be to find papers written by famous scientists that had their authors’ identities changed by mistake and were subsequently rejected. You could verify how many of these rejections were subsequently overturned after the true identities of the authors were established. Note that scholars are judged mostly on how many times their work is referenced in other people’s work, and thus cliques of people who quote one another are formed (it’s an “I quote you, you quote me” type of business).

Eventually, authors who are not often cited will drop out of the game, perhaps by taking a job with the government (if they are of a gentle nature), or with the Mafia, or with a Wall Street firm (if they have a high level of hormones). Those who receive a good push at the beginning of their scholarly careers will continue to reap persistent cumulative advantages throughout their lives. It is easier for the rich to get richer, for the famous to become more famous.

APPENDIX E

Matthew Effect in Reading, Learning & Knowledge Acquisition

Imagine you’re sitting in front of Charlie Munger and both of you are silently reading the same issue of The Economist. Can you guess who would end up with more insights at the end of this reading section?

That’s a no-brainer, isn’t it? The obvious answer is Charlie Munger. With all due respect to your intelligence, unless you are Warren Buffett, there is nobody on this planet who can match Munger’s brilliance.

And I am not saying that because I am a Munger fanatic. There is a strong reason behind my claim. Charlie is 92 and continues to read a boatload of books every year. Not only did he get an early start, but he has been accumulating knowledge for more than half a century.

Matthew effect, simply explained in this context, would be a person with more expertise has a larger knowledge base, and the large knowledge base allows that person to acquire even greater expertise at a faster rate.

So the amount of useful insights that Charlie can draw from the Economist would be quite high as compared to any other human being, and Munger would again end up becoming smarter at a faster rate.

As you learn to read more, your capacity to read even more and absorb more increases rapidly.

When I started reading books, most books didn’t make a whole lot of sense. But slowly I started finding connections between ideas spread across different books. These connections deepen understanding of those ideas and make the brain more efficient and smarter to make sense of the new information.

So start early to take advantage of the Matthew Effect in your quest for the acquisition of worldly wisdom.

Learning is a compounding game. It’s about steady growth over time, not momentary performance.

And learning is not additive; it’s synergistic. Knowledge doesn’t simply stack piece upon piece; it interacts. Vocabulary unlocks comprehension, comprehension fuels background knowledge, and background knowledge accelerates the acquisition of more vocabulary. The cycle feeds itself.

Changing long-term outcomes means designing for growth rates, not snapshots.

It also means intervening early, because once a compounding gap opens, it is brutally hard to close. Interventions often fail when they treat outcomes, not growth rates.

Daily reading habits exemplify the Matthew Effect in education, where small behavioural differences compound into dramatic learning disparities. Students who read consistently encounter vastly more words than sporadic readers, creating cascading benefits in vocabulary, comprehension, and cognitive processing that extend far beyond the reading itself.

Like compound interest, these modest daily choices accumulate into substantial gaps in academic achievement, transforming seemingly minor habits into powerful predictors of lifelong educational success.

APPENDIX F

FAME IS A LUCK MULTIPLIER

Fame multiplies luck because it compounds. At first, nothing much seems to happen; then, like a pension that quietly accrues, it suddenly accelerates. The more known you are, the easier it becomes to become even better known—for people and for brands.

Fame also widens your field of unexpected opportunity. Because I post on TikTok, I now get speaking requests from companies I’d never heard of. That’s the point: visibility pulls possibilities toward you.

Status works the same way. If you’re the CEO of a major firm—say, Rolls-Royce Aero Engines—almost anyone will return your call. Talent will join you for less money, stay longer, and bring you ideas you didn’t know to look for. Fame acts like a magnet: it raises your odds at the casino of life.

Think about teenagers and parties. They may not have a “party strategy,” but they intuitively know the math: go to more parties, and you increase the chance of something good—romantic, social, or an invitation that leads to something better. If you don’t go, you won’t get lucky. Serendipity requires surface area.

Bottom line: fame expands your surface area for luck. It doesn’t force outcomes—you can always accept or decline an opportunity—but it ensures that more of them find you.

Rory Sutherland shares how unexpected TikTok fame turned into a business advantage.

APPENDIX G

Factors Contributing to the Matthew Effect

Key Elements of the Matthew Effect:

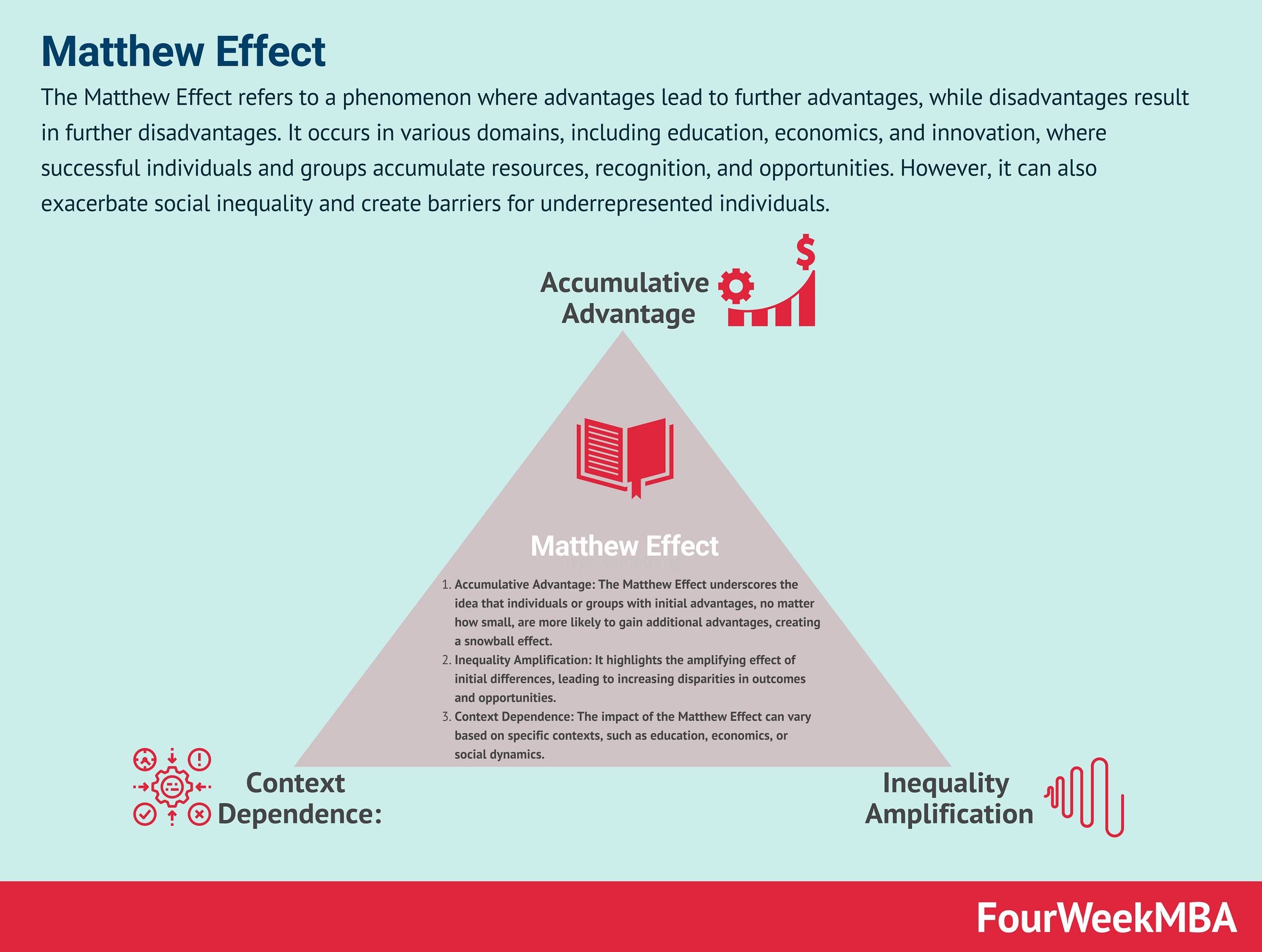

Accumulative Advantage: The Matthew Effect underscores the idea that individuals or groups with initial advantages, no matter how small, are more likely to gain additional advantages, creating a snowball effect.

Inequality Amplification: It highlights the amplifying effect of initial differences, leading to increasing disparities in outcomes and opportunities.

Context Dependence: The impact of the Matthew Effect can vary based on specific contexts, such as education, economics, or social dynamics.

Several factors contribute to the Matthew Effect, creating a self-reinforcing cycle of advantages and opportunities:

Accumulation of Resources: Individuals who start with certain resources, such as wealth, education, or social connections, have the means to access additional resources and opportunities. They can invest, start businesses, or pursue advanced education, all of which contribute to their continued success.

Recognition and Opportunities: Successful individuals who achieve recognition for their accomplishments often attract more opportunities, whether in career advancement, funding for projects, or collaborations. Recognition can come from various sources, including employers, peers, or the general public.

Network Effects: Established individuals tend to have extensive networks of contacts and connections, which they can leverage to gain further advantages and open doors to new opportunities. These networks can provide valuable insights, mentorship, and introductions to influential individuals.

APPENDIX H

RIGGED MONOPOLY GAMES

To clarify the concept of the Matthew effect, it may be useful to begin with a modern parable. In the board game of Monopoly, all players begin with equal resources. Yet equal opportunity at the start soon gives way to extreme inequalities in the distribution of resources. Though there may be ups and downs along the way, the richer players tend to get richer, and the poorer players poorer, until eventually the richest player has monopolized all resources and the poor are left with nothing at all. As successful players accumulate income-producing properties through a combination of skill and luck, their cumulative advantages enable them to reinvest new income in acquiring even more properties, generating additional income. This snowballing pattern of self-amplifying accumulation results in a Matthew effect that ultimately allows the most advantaged player to crush all opponents.

The sociologist Leonard Beeghly (1989) invites us to imagine a slight variation on the game of Monopoly that more nearly resembles real life. In Beeghly’s version, each player begins with a different sum of money. Let us suppose hypothetically that some players begin the game with $5,000, others begin with $1,000, and still others with only $500. Those who begin with $5,000 enjoy a considerable head start on the competition. They can well afford to acquire every property they want. What is the Matthew effect? land on, and they soon own a disproportionate share of the income-producing properties on the board. Those who follow after them are less able to afford properties of their own, and instead usually find themselves spending their limited resources in rent payments, enrich- ing the large owners and impoverishing themselves in the process. The laws of probability virtually ensure that under these conditions, the rich will get richer and the poor poorer, and through no special virtue or vice of their own. Initial advantages are parlayed into greater advantages, creating a widening gap between haves and have-nots— or, more precisely, between have-mores and have-lesses—through time.

It is true that everyone has some degree of opportunity to succeed in such a game, however small that chance may be, and in rare instances, a player who begins with fewer resources may win through some combination of luck and skill. But it is a statistical fallacy to claim that rich and poor players have an equal opportunity to succeed. The rules and initial conditions of the game virtually guarantee that inequalities widen as the game progresses, even among players who are identical to each other in every respect except initial monetary advantage. When two identical twins with the same level of talent and effort play this version of Monopoly against each other, the twin who begins with more resources almost always wins.

REFERENCES

https://www.safalniveshak.com/latticework-of-mental-models-matthew-effect/

https://fourweekmba.com/matthew-effect/

https://sobrief.com/books/the-matthew-effect

https://educationaccess.co.uk/the-matthew-effect/

https://conscious-manager.com/matthew-effect.html

https://www.amazon.in/Parable-Talents-Arch-Books/dp/0758612826

https://www.amazon.in/CUCKOOS-CALLING-CORMORAN-STRIKE-BOOK/dp/0751549258

https://dougantin.com/accumulated-advantage/

https://www.linkedin.com/pulse/matthew-effect-phil-roberts/

https://www.sivrihisar.com/stories.htm

https://www.linkedin.com/posts/rubendominguezibar_5000-turned-into-25-million-220000-activity-7380942470911692800-7h5v?utm_source=share&utm_medium=member_desktop&rcm=ACoAAEjT4ekBe444wqzgleKoNS17aSmxR5TYQ0w

https://www.reddit.com/r/Jokes/comments/2lm5y1/how_to_get_rich/

https://www.linkedin.com/feed/update/urn:li:activity:7372883354763038720/

https://medicalexecutivepost.com/2025/01/28/robert-lucas-paradox-law-of-diminishing-returns/

https://writingcooperative.com/how-the-matthew-effect-explains-writing-success-a2382c32860a

https://money-meets-life.com/why-money-attracts/

https://newsroom.haas.berkeley.edu/matthew-effect-how-early-career-wins-yield-large-and-lasting-advantages/

https://www.cdc.gov/polaris/php/thinking-in-systems/looking-for-feedback.html